Integris Industrial Development Fund

INVESTMENT SUMMARY

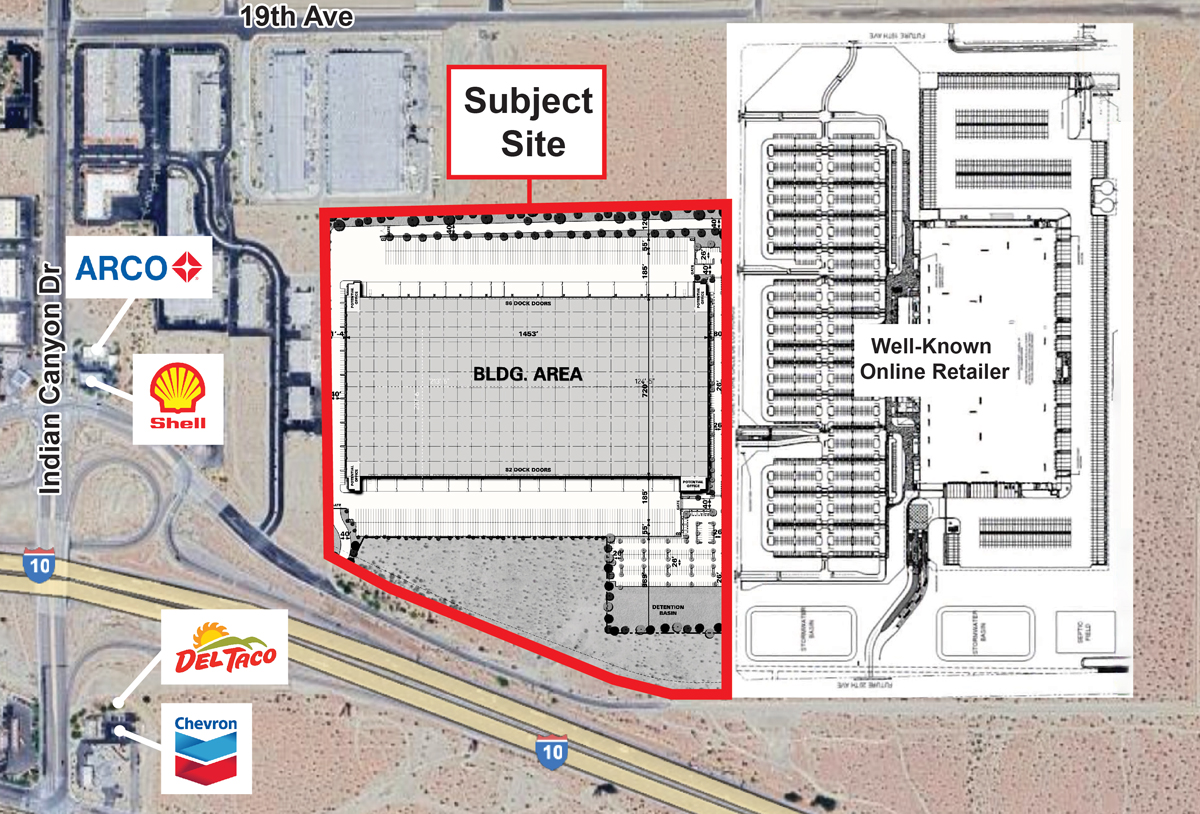

Integris Industrial Development Fund is under contract1 to purchase approximately 55 acres of vacant land in Riverside County, California. Currently approved for industrial development, the fund plans to construct approximately 1 million square feet of distribution/warehouse space. Upon completion, the asset is anticipated to be sold.2

VIEW OFFERING MATERIALS

The rendering shows the type of product anticipated to be developed by the company and does not represent the actual development, which may vary materially from the rendering shown here.

PROJECT DETAILS

- Strategically located in the heart of the Inland Empire

- Existing entitlements in place for industrial use

- Develop an approximately 1 million-square-foot distribution/warehouse space

- 55-acre development site

- Adjacent to a future, well-known online retailer warehouse space

- Direct access to the I-10 freeway

- Access to the Southern California port complex

WHY INVEST?

- Strategically located in the heart of the Inland Empire, the industrial development project offers the unique opportunity to secure a 55-acre development site with direct access to one of Southern California’s largest trade routes, the I-10 freeway. The fund is currently under contract to purchase the land, with an estimated closing in June 2024.

- With existing entitlements in place for industrial use, the Fund plans to develop an approximately 1 million-square-foot distribution/warehouse space.

- Additionally, the subject site is located adjacent to a future, well-known online retailer warehouse space, which is currently under development. The retailer has already initiated off-site development work for its project.3

- Strategically located for logistics as continued growth in ecommerce companies drives demand for industrial space.4

- Access to the Southern California port complex offers significant drayage savings compared to projects in Arizona.

- Inland Empire West is one of the premier markets for industrial users, attracting firms seeking to consolidate their operations into large, state-of-the-art facilities. The region experiences high demand with its proximity to major ports like Los Angeles and Long Beach.

The image shows a preliminary site plan. Terms are subject to change.

How the Investment Process Works

1. ARE YOU AN ACCREDITED INVESTOR?

Click here to verify your status.

2. REVIEW INVESTMENT OPPORTUNITIES

As a verified investor, you now have in-depth access to each investment offering.

3. INVEST

Complete your transaction online.

1. Under contract, with an outside acquisition to be completed in June 2024.

2. There is no assurance that this strategy will succeed to meet its investment objectives.

3. The success or failure of our project hinges on numerous internal factors, such as our strategy, execution, and adaptability. While the presence of a major online retailer provides context to our environment, it does not determine the outcome of our project. Neither Integris Real Estate Investments nor Shopoff Securities Inc. is affiliated with this major online retailer. https://therealdeal.com/la/2022/06/27/amazon-buys-120-acre-site-set-for-3-4m-sf-e-commerce-center/.

4. CBRE U.S. industrial & Logistics Market Report, January 2024.

*An “accredited investor:”

1. Has income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year.

OR

2. Has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence). Visit the SEC website for more information on what is an accredited investor.

You should read the memorandum for any prospective investment and examine the suitability of this type of investment in the context of your own needs, investment objectives, and financial capabilities and should make your own independent investigation and decision as to suitability and as to the risk and potential gain involved. Also, you are strongly encouraged to consult with your own tax advisor and your own attorney, accountant, financial consultant or other business advisor regarding the risks and merits of the proposed investment. This communication and any memorandum do not constitute tax advice to any prospective investor.

Integris Industrial Development, LLC Fund is a 506(c) offering, as defined by the U.S. Securities and Exchange Commission, for accredited investors only. This is neither an offer to sell nor a solicitation of an offer to buy any security. An investment in a limited partnership involves a high degree of risk, including the possible loss of your investment, and is illiquid with an uncertain liquidity date. Past performance is not indicative of future results. Securities offered through Shopoff Securities, Inc., member FINRA/SIPC.

Important Information – Risk Factors

An investment in Integris Industrial Development, LLC Fund (the “Fund”) must be considered speculative and adds a high degree of risk. There are no guarantees of distributions or returns, and an Investor may lose all or part of their investment. There are various risks related to an investment in the Fund which are described in the Private Placement Memorandum. These risks include, but are not limited to:

- The Interests may not be suitable for certain Investors.

- The Interests will be highly illiquid, no trading market exists or will ever develop, and withdrawals of capital contributions are prohibited. Investments in the firm’s funds involve a high degree of risk, including complete loss of your investment.

- Investors may have tax-related risks, including Unrelated Business Taxable Income (UBTI) to Investors in Qualified Plans and the uncertainty regarding future taxes.

- The Fund is a recently formed entity with no operating history and no assurance of success.

- Success is dependent on the performance of the Managing Manager, the Sponsor, and its affiliates. Performance has varied, with certain offerings having generated losses that are detailed in the Sponsor track record, available in the Memorandum.

- The Fund depends on key personnel of the Managing Manager and its affiliates, the loss of any of whom could be detrimental to the Fund’s business.

- The Fund will pay substantial fees and expenses to the Managing Member and its affiliates and broker-dealers. These fees will increase Investors’ risk of loss.

- The Fund will be subject to conflicts of interest arising out of relationships among the Sponsor, the Managing Member, and their affiliates.

- Real estate-related investments, including joint ventures, co-investments, and real estate-related securities, involve substantial risks. There are substantial risks associated with owning, financing, developing, operating, and leasing real estate, and value-added real estate investments may involve additional risks.

- Economic, market, and regulatory changes that impact the real estate market generally may decrease the value of a Fund’s investments and weaken operating results.

- The Fund will likely obtain debt financing, which increases costs and risk of loss due to foreclosure and may limit its ability to pay distributions to Investors.

- There are uncertainties in the investment strategies including but not limited to increased costs, delays, and risk of ownership in the entitlement and development processes; uncertain or weak general market conditions relating to the future disposition of the Property.

- The success of the Fund is dependent on approvals from local agencies, including but not limited to the city of Desert Hot Springs, that is outside of the Managing Member’s control.

- An investment in the Fund involves significant risks, described in detail in the Memorandum.